Where does android pei work. Android Pay: how does it work and how to use it? What cards can be connected

Android Pay- it's free and convenient service mobile payments developed by Google for Android device owners.

Attention! Android Pay is now called .

Downloading Android Pay is recommended for every user, because the software allows you to make purchases and pay for services in any convenient place where NFC contactless payment technology is supported, as well as in applications and the Internet.

Android Pay will help you further expand the capabilities of your gadget and keep all your debit, credit and loyalty cards in one place. To pay in a store, there is no need to even go into the application; you just need to make sure that the smartphone is unlocked and bring it to the terminal.

And to pay online, you no longer need to enter data every time - just select a service among payment methods and save time.

Peculiarities:

- physical security with mandatory fingerprint scanning, entering a pattern key or digital password;

- Creation virtual number account representing and storing information about account user;

- sending a randomly generated one-time code instead of user data when making a payment;

- smart authentication to determine the security system of the device being used.

The main requirements for working with Android Pay is the mobile version operating system Android 4.4 and higher, support NFC technology on the gadget, as well as a card of the bank that has entered into an agreement with the creator of the service to provide similar services for its clients.

If you add a card from a bank that is not a partner of the system, you will not be able to use and register it. Android Pay will not work if your device:

- Pre-installed OS Android 4.3 and below, or version for developers.

- Hacking with root access rights, custom firmware or modified standard settings the OS itself.

- Installed Samsung app MyKnox.

- There was no verification from Google.

- The operating system bootloader is unlocked.

If the user already has cards linked to his Google account, he can immediately add them to Android Pay. If there are none, you will have to enter all the data yourself.

By the way, users have noticed frequent errors when trying to use the gadget’s camera to enter information from cards, so it is better to immediately enter the details manually. The card will be confirmed either by message or by calling a bank representative.

Although the purchases themselves can be made without connecting to the network, after some time they will still require a connection to it. The latter is due to the fact that, unlike other similar services, Android Pay stores all transaction data not in the gadget’s memory, but in a virtual cloud.

Downloading Android Pay to your mobile device, smartphone or tablet, is recommended for anyone who wants to quickly and easily pay for any purchases directly from their phone.

After yesterday’s article, readers still have several questions about the operation of the service, in this article I will try to answer them.

How to connect Android Pay?

To use Android Pay, you will need a smartphone with NFC support and version Android 4.4, a card from one of the banks listed below and the application of the same name installed.

Important clarification: the service does not work if you have a root or an unlocked bootloader. Interestingly, on some Xiaomi devices with official firmware and a closed bootloader, Android Pay still did not work. Also, one of the owners of Huawei Honor 8 Pro (certified version from the online store) complained about the unavailability of the application.

Interesting fact: If you already have any cards linked to your Google account, you can immediately connect them to Android Pay. If there are no such cards, you will have to enter the card details in full. By the way, the built-in data reader incorrectly identifies the card number in half the cases, so I recommend entering it manually.

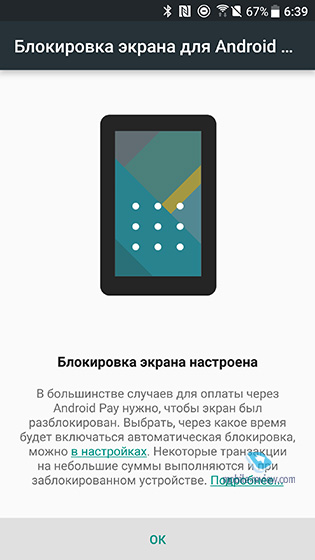

Before adding a card, make sure you have a PIN code or lock using a key or fingerprint scanner. Without this, the service will not work.

You can confirm your card either by SMS or by calling the call center.

Then we accept the terms using Android Pay together with the selected bank and set this payment method as the default.

How to pay?

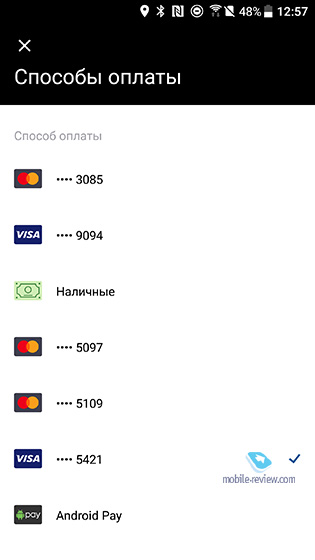

If you have connected several cards, then initially the payment is made with the one that is selected by default. If you want to pay with another card, you need to open Android Pay and select it manually.

To pay for purchases up to 1000 rubles, you just need to turn on the smartphone screen and touch it to the terminal, the payment will go through automatically. To pay for a purchase for a large amount, you first need to unlock your smartphone and enter the PIN code in the terminal. I liked that for small amounts the switched-on screen is enough, there is no need to call up the payment window double click button, like on iOS, and then hold your finger on the scanner for the payment to go through. iPhone owners wrote yesterday that you can touch your iPhone with the display turned off, holding your thumb on the scanner and the payment will go through, but the fact is that on older iPhones the scanner works slowly, as a result, more time is spent on payment, and sometimes you have to try twice.

You can make purchases without the Internet, but all information about purchases is stored on the network and not on the internal drive, so after several such transactions the AP will still ask you to connect to the network. And this is its disadvantage in comparison with Apple Pay and Samsung Pay.

In theory, you can also pay from your watch, but my Huawei Watch 2, despite having NFC, for some reason did not support this feature.

In addition to offline purchases, Android Pay can also be used for in-app payments. At the moment it is already available in Uber, Delivery Club, OneTwoTrip and Rambler.Checkout. Later, it should also be possible to pay on online store sites.

Safety

The main security question that has been asked many times is: what to do with the fact that you don’t need to unlock your smartphone to pay up to 1000 rubles? I read on iGuides that the maximum number of payments without unlocking the smartphone is limited to three, but I saw this mention too late, so I’ll check it myself tomorrow. But in principle, such a restriction seems logical, and if the smartphone is lost, the attacker will be able to spend no more than 3,000 rubles.

Another horror story is people in public transport, walking around with terminals and discreetly applying them to passengers’ smartphones. In my opinion, this is also an implausible story, because it is not so easy to get a payment terminal and in case of such fraud it will not be difficult to identify the thief. Plus, for such a payment, at least the smartphone screen must be turned on, which means it is in your hand, so you will see a scammer with a terminal.

I will say this: any payment instrument, from a regular cash wallet to Android Pay, is always a small risk. In most cases, convenience justifies the mythical possibility of theft or fraud, but if you are very worried, you can either increase the limits in Internet banking or not use cards at all.

Loyalty cards

In addition to bank cards, you can also add loyalty cards to AP. The main stores are already in the service database, although it was funny with Victoria’s card, I seemed to find it in the list, entered the number, and then it turned out that if you go to the store’s website, you will not be taken to the supermarket page at all.

What do online banking purchases look like?

Advanced banking users asked to clarify whether the MCC code changes when paying via Android Pay? I answer - it doesn’t change, the transaction goes through the same way as if you paid with a card. Some banks, for example Tinkoff, place a small wireless payment icon next to such purchases so that you understand what you paid through.

Possible problems when returning

Since each purchase generates its own token, problems may arise when returning goods. If you come to return something, then you must make the return exactly through the terminal through which the purchase was made, because for other terminals the token will be different. In general, I recommend not to be lazy and for large purchases, take out a bank card from your pocket, and not show off with payment by phone.

Promotions and discounts

All promotions with Android Pay work as follows. You pay for the purchase, and then immediately part of it is returned to the card.

The most famous promotion for the launch of Android Pay is trips to the metro and MCC for one ruble. Or rather, initially they should have been for rubles, but later the conditions were changed to a 50% discount, and even later it turned out that the promotion would be valid from June 23rd.

Another promotion is a 50% discount when paying for an Aeroexpress ticket via Android Pay. It is valid only for the first 3000 participants and works great, my friend has already used it. It is important to use the linked Mastercard payment system card.

The third promotion gives a 50% discount on any sandwich at Burger King, but is also valid only for Mastercard cards.

Conclusion

Some users complained about some roughness in the operation of Android Pay, personally, I am inclined to attribute them to specific terminals and smartphones, since in my case there were no problems, the payment took place instantly.

The real problem is the location of the terminals at some points. For example, KFC in Prince Plaza keeps all the terminals near the cashiers and you have to reach for them in order to make a payment with your smartphone, and Victoria does not display an offer to pay contactless at all, although it actually works.

The volume of mobile payments in Russia is growing rapidly. Smartphone payment technology simplifies and speeds up financial transactions. Didn't stand aside Google company, which launched its payment service – Android Pay – on May 23, 2017. Let's figure out what Android Pay is and how to use it

What is Android Pay

Android Pay is a kind of virtual wallet that allows you to make cashless payments for goods and services using a smartphone running the operating system. Android systems. The means of payment is a bank card of one of the system’s partner banks, registered with the payment service and linked to an application on a smartphone or other mobile device that supports .

To make a payment, just bring your smartphone to the POS terminal, which also supports NFC. If there are no NFC terminals, payment will have to be made by card.

How to use Android Pay to pay

To use the payment service, the following conditions are required:

- A device that supports NFC contactless data transfer technology. The presence of NFC is indicated by the corresponding abbreviation on the back cover of the device or can be viewed in the Android settings " Settings > Wireless & networks >NFC»

- The device must be running Android 4.4 or higher.

- For safety reasons, the device should only have official firmware, there should not be an unlocked bootloader.

- Availability of a partner bank card. It will not be possible to register a card from another bank.

If all conditions are met, you can link the card in the payment service. If at least one of the requirements is not met, it will be impossible to work with the payment service.

How to link a card to Android Pay

At the time of publication of this article, the following banks work with Android Pay:

- Sberbank;

- Yandex Money;

- VTB24;

- Binbank;

- Tinkoff;

- Alfa-Bank;

- Ak Bars;

- Opening;

- Rosselkhozbank;

- Raiffeisen;

- Dot;

- Russian Standard;

- Rocketbank;

- MTS Bank;

- Promsvyazbank.

To link a card from one of these banks, follow the instructions:

- IN Google Play find and install Android app Pay.

- Open the application. If you already have a card linked to Google account Paly, then you can select it. If there is no link or you want to register another card in the service, then manually enter the requested data.

- Accept the terms and conditions of the payment service and the bank that issued the card.

- Wait until your card is verified.

- For security purposes, the app will ask you to set a screen lock if you don't have one. This is a reasonable requirement: if someone gains access to your phone if it is stolen or lost, they will not be able to use your money. Although the blocking can be removed using some methods, at this time you will already disconnect the card from Android Pay.

- During the process of registering a card in the service, you will receive a verification SMS with a code that must be entered in the appropriate field of the application.

In the process of linking the card to the service, a verification debit of 30 rubles will occur from it, which after some time will be returned back to the card. Don't be alarmed.

After completing all the steps, you will be able to fully use Android Pay services.

How to remove a card from the Android Pay service

If you want to remove a linked card from the payment service, you can do this in two ways:

How to pay using Android Pay

Pay with using Android Pay is as convenient and simple as possible. Before paying, unlock the screen and make sure NFC is enabled. Then simply bring your smartphone to the terminal (no need to launch the application) and follow the instructions on the terminal. When paying up to 1000 rubles. There is no need to confirm the purchase with a PIN code. Wait for confirmation of successful payment and take away the phone. If your mobile bank is connected, you will receive an SMS message about the balance on the card. The payment service does not charge any commission or subscription fee.

Safety

When paying with Android Pay, card data is not transmitted; a one-time code is transmitted, which, even if intercepted, does not represent any value to the attacker.

Using Android Pay is an opportunity to make purchases conveniently and in a safe way. Read on and you will find out how to pay via Android service Pay for the things you need in stores and online applications.

How to pay using Android Pay in a store

So, you are in the store and are about to make a payment for the selected product using the Android Pay service. What you need to do for this:

Thus, the payment is made from the default card.

How to change the main card?

You can add several cards from different banks to the application, and here are your actions if you need to pay for a purchase with an additional card:

- Unlock your smartphone

- Go to the Android Pay app, select and tap the card you want to use at the moment

- Click "Set card as primary"

- Next, follow the steps described in the previous instructions.

Errors when paying with Android Pay and what to do about them

Let's look at some problems that may arise when paying in store. If you encounter them, it’s okay, everything can be fixed.

You touched the device to the terminal, but payment does not occur

- Forgot to wake up the phone from sleep mode. You don't need to open Android Pay, but your smartphone must be unlocked.

- The NFC antenna did not pick up the signal. Just try changing the position of the phone relative to the terminal.

- The smartphone was removed from the terminal too quickly. The operation is carried out within a few seconds, but still give a little time if this does not happen immediately. Wait for the green flag to appear.

You can find out about other problems and ways to solve them in our other article.

The smartphone began to vibrate and a green flag appeared on the screen

This reaction means that Android Pay transmitted payment information, but for some reason the terminal did not accept it. You can ask the cashier for help and try again.

You need to pay with a card with a chip, enter a PIN code

This means that the store does not accept payments through the application; you can only pay with a regular card.

Card declined

In this case, only the bank will help, since Google support does not have information about the reasons for the rejection of cards or any transactions on them.

How to pay via Android Pay online

To pay in applications, just one touch of your finger is enough to confirm your payment. Look for the mark “Payment with Android Pay” or a picture of a green robot.

Security of Android Pay transactions

The basis of transactions carried out through this service is the formation of a unique digital code, which is transmitted to the seller instead of your card data. This way, confidential information will not be available to anyone except you.

The mobile payment service Google Pay (formerly Android Pay) became available in Russia on May 22, 2017, unlike competitors Samsung Pay and, which appeared on the Russian mobile payment market a year earlier (in the fall of 2016). However, it turned out to be very popular, and quickly began to “win a place in the sun”, since it is available for numerous smartphones running on Android based, and equipped with an NFC contactless payment chip (abbreviated from the English Near Field Communication). By the way, today not only expensive but also budget phone models are equipped with such chips. Competitors of the Google service work only with expensive flagships, despite the fact that the operating principle of all three payment platforms is almost the same.

In the review, we will describe in simple and accessible language how the free Google Pay payment system works, how you can connect it, how to use it, and talk about various interesting nuances of using this modern technology.

Google Pay (Android Pay). What is this? How does it work? Speed, convenience, security, and all for free

Tokens and payment tokenization

The Google Pay system, like its famous competitors, is based on the so-called payment tokenization technologies, which itself is implemented on the basis of the IPU (international payment systems) Visa and MasterCard (and soon we expect something similar from). The meaning of the technology is to transfer from the smartphone to the seller and further (details below) tokens instead of card numbers.

A token is a unique combination of numbers that DOES NOT CONTAIN card numbers or other data that can be intercepted.

The token is generated by the payment system and the issuing bank (which issued the card), and is used for further payment. It may only apply to a specific smartphone, a specific type of purchase (or even a specific retailer), and it may have a limited validity period (for example, it may only be valid for a few purchases).

In the Google Pay system, such tokens are called virtual accounts. If an attacker intercepts such a virtual account, he will not be able to do anything with it, since its reuse from another mobile device or from another Internet service will immediately lead to blocking of the payment transaction by payment systems.

In the process of contactless payment, tokens are transmitted as a regular request for authorization (read,) with the only difference that an additional link appears in the transaction processing chain - the so-called payment tokenization service (or tokenization service provider). The task of this service is to check whether a token belongs to a specific bank card number (in other words, to decrypt it) and transfer this number to the issuing bank to authorize payment.

The functions of tokenization services, depending on the type of payment system used to pay for the card, are performed by the Visa IPS division - VTS (Visa Token Service), and the MasterCard IPS division - MDES (Mastercard Digital Enablement Service). As you can see, these companies can be trusted.

And to reinforce the material, we suggest you familiarize yourself with the infographic: “How Visa Token Service Works,” taken from the payment system website of the same name.

Well Android Pay's task is as follows:

- request a token from the issuing bank (in other words, tokenize the card);

- save the encrypted card in the cloud Google service(on secure servers);

- transfer the token and cryptogram, which acts as a one-time code, to the seller upon payment.

This is where all actions of this service end. In fact, this payment service is a “superstructure” over the data processing technology in the above-mentioned MPS, on which the entire payment infrastructure in Russia and around the world is built.

As Google points out in its payment technology description:

- Google Pay does not process or authorize transactions. The application only tokenizes cards and transfers tokens and other customer information to payment systems.

- Neither the seller nor the buyer needs to change their payment system - for them everything remains as it was.

This “payment add-on” allows owners of Android smartphones with an NFC chip to “enter” all their bank, gift and discount (discount) cards into the Android Pay application on their phone and SAFELY pay with them at regular retail outlets - just unlock the phone, bring it to terminal that supports , and the goods will be immediately paid for from your pre-selected card (the “active” card can be selected in advance). To be sure that the outlet supports contactless payment, look for stickers with the corresponding logos near the cash register:

Payment technology

Below is a step-by-step description of the contactless payment process, taken from the Google help site (https://support.google.com/androidpay/merchant/answer/6345242?hl=ru).

How to connect?

In order to start using this payment service, you must:

You can add several cards from different banks to the application; do not forget to assign a default card for payment. Make sure that the NFC contactless payment option is activated on your phone (it can be disabled if not needed).

For information: If you add a bank card from a partner bank to Google Pay, you will be able to use all the loyalty programs, bonuses, privileges and protection mechanisms that are provided for it by your bank.

What banks and cards does it work with?

Most well-known banks cooperate with Google Pay:

- Sberbank

- Alfa Bank

- Raiffeisen Bank

- Tinkoff

- Gazprombank

- Binbank

- MTS Bank

- Promsvyazbank

- Otkritie Bank

- AK Bars

- Bank Saint Petersburg

- Rosselkhozbank

- Russian Standard

- VTB24

- Rocketbank

- Dot

The payment service is also compatible with cards of the domestic electronic payment service Yandex.Money (you can add a plastic and virtual card).

Currently, the service supports cards from well-known payment systems Visa, MasterCard, American Express and Diners Club (we expect support for MIR cards). The current list of cards that are and are not supported by the service can be found in Google help at the link: https://support.google.com/androidpay/answer/7397640.

What devices does it work with?

It is noteworthy that this service is compatible with a large number of devices. Almost all modern mobile phones, as well as a number of older models based on Android with the possibility of contactless payment will work perfectly with it.

The operating conditions of the payment service are as follows:

- The device must be reviewed and approved by Google;

- Android version no lower than 4.4 KitKat (2013) on smartphones or smartwatches with an NFC chip (NFC function must be enabled);

- the device should not have a developer version of the operating system (hereinafter referred to as the OS) installed;

- The OS bootloader must not be unlocked;

- The device should not have root rights installed, not factory (not original) firmware, and there should be no changes to the factory OS settings. This applies to products with Chinese online stores: their owners may not even suspect that the new Xiaomi has unofficial firmware and will be very upset when they cannot install the required application.

- The smartphone must not have the Samsung MyKnox app installed (provides additional protection when using Samsung Pay).

Below you can see the models of those devices that are INCOMPATIBLE with Google Pay:

- Elephone P9000;

- Evo 4G LTE;

- Nexus 7 (2012 model);

- Samsung Galaxy Note III;

- Samsung Galaxy S3;

- Samsung Galaxy Light.

As you can see, Google does not provide a limited list of supported devices, but only talks about a number of quite democratic requirements that must be met by the smartphone you choose (although follow the link: https://support.google.com/androidpay/answer/7385877?hl=ru&ref_topic =6224829 you can see a partial list of supported models).

The advice here is simple: buy phones from official equipment suppliers and check in advance whether Google Pay will work on your device.

How to use Google Pay and where can I pay?

Where can I pay?

You can use the function in all stores that support contactless payment (today the majority of such terminals). Pay attention to the corresponding logos or ask the cashier about this option.

You also have the opportunity to pay for goods and services in applications and online stores, where you will see the corresponding signs:

How to pay?

To pay from a pre-installed default (main) bank card, you need to perform a few simple steps:

- Wake up your phone (wake it from sleep mode and unlock it);

- Bring (attach) the phone rear panel to the payment terminal and hold it for 2 seconds, the appearance of a green flag (tick) on the screen will indicate payment (there is no need to download the application - it will download automatically);

- If the payment amount is less than 1000 rubles, then no action is required (similar to a card with PayPass/PayWave). If the payment amount is more than 1000 rubles, then you will need to enter the card PIN code at the terminal or sign the receipt.

Video of the payment process below:

When paying in an online store, just click on the appropriate button (see above).

Some nuances when paying

- For a purchase amount of up to 1000 rubles, it is enough to wake up the smartphone from sleep mode (without the need to unlock), and you can pay for up to 3 purchases in a row (the 4th purchase will require unlocking);

- When Internet access is turned off, you can perform up to 10 operations;

- If you decide to disable automatic screen locking, then for security reasons information about all cards will be deleted - you will have to add all cards again;

- For payment to work, in some cases it is necessary to activate the Android Pay function using your bank card at the bank (by phone or in online banking);

- Judging by the reviews on the forums (including on http://4pda.ru), sometimes payments in the amount of more than 1 thousand rubles do not go through. To do this, you can try changing the blocking method (for example, graphic key to pin or vice versa). In this case, if, when paying, the phone (application) asks you to enter a PIN code, to do this you need to enter the PIN to unlock the phone (if the appropriate blocking method is used), and not the card PIN code (sometimes confusion arises).

What to do if your phone is lost or stolen?

If you have lost your phone or it has been stolen from you, then you can use the “Remote Android control"(https://support.google.com/accounts/answer/3265955). With it, you can find the device (if it is turned on), block it, or erase all data from it.

You won't be able to launch Google Pay on a locked device. If it is impossible to establish a connection, you have the opportunity to erase all payment data (they are located on Google’s secure servers). After finding the phone, you will have to re-add all the necessary information to the application.

Since a virtual account number is used to pay for purchases, no one will be able to find out information about your cards, even if the phone is unlocked.

By the way, if the device is not used for 90 days, then information about the added cards is deleted.

Advantages and disadvantages of Google Pay

Google Pay is a truly convenient and secure system that is hard to find fault with. But, like everything in this world, it has its pros and cons. Let's look at its advantages and disadvantages.

Advantages

Convenience and compactness. You can add several payment cards to your smartphone. In this case, there is no need to carry many cards with you, including discount cards. You can always use the card with which payment is most profitable for you (more cashback, additional privileges, etc.)

Versatility and accessibility. Unlike other similar services, Android Pay supports a fairly large number of Android-based devices that meet Google’s quite affordable requirements;

Safety. During payment, the card number is not transmitted - only a token (virtual account) is transmitted, which has no practical value for an attacker. Even if this information somehow gets into the hands of scammers, they will not be able to use it;

No commission. Installation, use and payment using this payment service is completely free for smartphone owners!

Flaws

You cannot withdraw cash from ATMs (more precisely, this operation is only available in those few ATMs that support contactless exchange with devices);

Your payment transactions completely depend on the current state of the gadget and battery. Fortunately, inexpensive portable ones are available today. chargers and models with increased battery capacity;

Judging by the reviews, sometimes errors occur, for example, the application does not install on a new, unlocked smartphone with a licensed OS, or payments over 1,000 rubles do not go through.

The devices do not have a dedicated data protection area to store information about bank card in encrypted form, but all data is stored on encrypted Google servers(in the cloud).